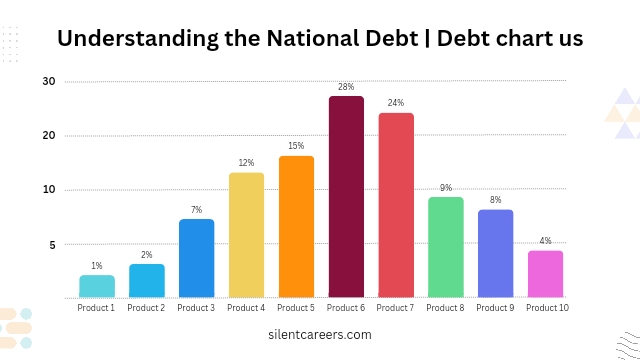

Debt chart us: In the U.S., consumer debt is typically divided into several categories, each representing different types of financial obligations. Here’s a simplified breakdown:

- Mortgage Debt: 70%

- Student Loans: 10%

- Auto Loans: 9%

- Credit Card Debt: 6%

- Other: 5%

This chart shows that mortgages constitute the majority of consumer debt, followed by student loans and auto loans.

What is the national debt?

The national debt is the total amount of money that a country’s government has borrowed and owes to creditors. This debt accumulates over time when the government spends more than it collects in revenues, such as taxes.

Key Points About the National Debt:

- Public Debt: Money owed to external creditors, including foreign governments, investors, and international organizations.

- Intragovernmental Debt: Money owed to various government programs, like Social Security and Medicare, which are funded by special Treasury bonds.

- Debt Instruments: Issued as Treasury bills, notes, and bonds to finance the debt.

- Economic Impact: High national debt can lead to higher interest rates, inflation, and reduced investment in public services.

- Management: Managed by the U.S. Department of the Treasury, which handles borrowing and repayment.

Current Status

As of the latest figures, the U.S. national debt exceeds $30 trillion, reflecting the cumulative borrowing by the federal government. This figure is subject to change based on government spending, revenue collection, and economic conditions.

The National Debt Explained / Understanding the National Debt

The national debt is the total amount of money that a country’s government has borrowed and still owes. It represents the accumulation of yearly budget deficits, where government expenditures exceed revenues. Understanding the national debt involves looking at its components, implications, and how it is managed.

Components of the National Debt

- Public Debt:

- Definition: Debt held by external creditors, including individuals, corporations, foreign governments, and institutions.

- Instruments: Treasury bills, notes, and bonds.

- Importance: Indicates the amount borrowed from investors to fund government operations.

- Intragovernmental Debt:

- Definition: Money the federal government owes to various federal programs and trust funds, such as Social Security and Medicare.

- Instruments: Special Treasury securities.

- Importance: Reflects obligations to government programs funded by dedicated revenues.

How the National Debt is Managed

- Issuing Debt:

- Treasury Securities: The U.S. Department of the Treasury issues securities to borrow money. These include short-term bills, medium-term notes, and long-term bonds.

- Auctions: Treasury securities are sold at regular auctions to investors.

- Interest Payments:

- Obligations: The government must pay interest to bondholders, which is a significant part of federal expenditures.

- Rates: Interest rates on Treasury securities vary based on their duration and market conditions.

Implications of the National Debt

- Economic Impact:

- Interest Rates: High national debt can lead to higher interest rates as the government competes with the private sector for borrowed funds.

- Inflation: Excessive borrowing can contribute to inflation if it leads to an oversupply of money.

- Fiscal Policy:

- Budget Constraints: High debt levels can limit the government’s ability to implement fiscal policies and fund public services.

- Debt Ceiling: The U.S. Congress sets a debt ceiling, which is the maximum amount the government is allowed to borrow. Debates over raising the ceiling can impact financial markets and government operations.

- Long-Term Concerns:

- Sustainability: Persistent high levels of debt can raise concerns about the government’s ability to meet its obligations in the long term.

- Future Generations: Rising debt levels can impose financial burdens on future generations through higher taxes or reduced public services.

The national debt reflects the total borrowing by the federal government to cover budget deficits. Managed through Treasury securities, it comprises public debt and intragovernmental holdings. While necessary for funding government operations, the national debt has significant implications for the economy, fiscal policy, and future financial stability. Understanding its components and impact helps in grasping the broader economic picture.

U.S. National Debt by President

The U.S. national debt has fluctuated significantly over the years, influenced by various policies, economic conditions, and unforeseen events. Here’s an overview of the national debt during the tenure of recent U.S. presidents:

Ronald Reagan (1981-1989)

- National Debt at Start: $998 billion

- National Debt at End: $2.6 trillion

- Key Factors: Increased defense spending, tax cuts, economic recovery from stagflation.

George H.W. Bush (1989-1993)

- National Debt at Start: $2.6 trillion

- National Debt at End: $4.2 trillion

- Key Factors: Gulf War, economic recession, and bailouts.

Bill Clinton (1993-2001)

- National Debt at Start: $4.2 trillion

- National Debt at End: $5.7 trillion

- Key Factors: Economic growth, budget surpluses in the late 1990s.

George W. Bush (2001-2009)

- National Debt at Start: $5.7 trillion

- National Debt at End: $10.6 trillion

- Key Factors: Tax cuts, wars in Iraq and Afghanistan, 2008 financial crisis.

Barack Obama (2009-2017)

- National Debt at Start: $10.6 trillion

- National Debt at End: $19.9 trillion

- Key Factors: Stimulus spending to combat the Great Recession, Affordable Care Act, continued military expenditures.

Donald Trump (2017-2021)

- National Debt at Start: $19.9 trillion

- National Debt at End: $27.8 trillion

- Key Factors: Tax cuts, increased military spending, COVID-19 pandemic relief packages.

Joe Biden (2021-Present)

- National Debt at Start: $27.8 trillion

- National Debt (as of July 2024): Over $30 trillion

- Key Factors: COVID-19 pandemic recovery, infrastructure investments, social spending initiatives.

Summary

- Ronald Reagan: $998 billion to $2.6 trillion

- George H.W. Bush: $2.6 trillion to $4.2 trillion

- Bill Clinton: $4.2 trillion to $5.7 trillion

- George W. Bush: $5.7 trillion to $10.6 trillion

- Barack Obama: $10.6 trillion to $19.9 trillion

- Donald Trump: $19.9 trillion to $27.8 trillion

- Joe Biden: $27.8 trillion to over $30 trillion

The national debt’s growth reflects a combination of tax policies, spending initiatives, economic conditions, and unexpected events such as wars and pandemics.

History of the U.S. Debt by President

The U.S. national debt has evolved significantly over time, with various presidents contributing to its rise or stabilization through their fiscal policies. Here is a detailed look at the U.S. national debt by president, highlighting the key factors influencing its growth.

Franklin D. Roosevelt (1933-1945)

- National Debt at Start: $22.5 billion

- National Debt at End: $258.7 billion

- Key Factors: New Deal programs, World War II expenditures.

Harry S. Truman (1945-1953)

- National Debt at Start: $258.7 billion

- National Debt at End: $266.1 billion

- Key Factors: Post-WWII demobilization, beginning of the Cold War, Korean War.

Dwight D. Eisenhower (1953-1961)

- National Debt at Start: $266.1 billion

- National Debt at End: $292.6 billion

- Key Factors: Interstate Highway System, Cold War military spending.

John F. Kennedy (1961-1963)

- National Debt at Start: $292.6 billion

- National Debt at End: $305.1 billion

- Key Factors: Space Race, Cold War expenditures.

Lyndon B. Johnson (1963-1969)

- National Debt at Start: $305.1 billion

- National Debt at End: $368.7 billion

- Key Factors: Vietnam War, Great Society programs.

Richard Nixon (1969-1974)

- National Debt at Start: $368.7 billion

- National Debt at End: $475.1 billion

- Key Factors: Vietnam War continuation, inflation.

Gerald Ford (1974-1977)

- National Debt at Start: $475.1 billion

- National Debt at End: $653.6 billion

- Key Factors: Inflation, recession.

Jimmy Carter (1977-1981)

- National Debt at Start: $653.6 billion

- National Debt at End: $930.2 billion

- Key Factors: Economic stagnation, energy crisis.

Ronald Reagan (1981-1989)

- National Debt at Start: $998 billion

- National Debt at End: $2.6 trillion

- Key Factors: Tax cuts, increased defense spending, economic recovery programs.

George H.W. Bush (1989-1993)

- National Debt at Start: $2.6 trillion

- National Debt at End: $4.2 trillion

- Key Factors: Gulf War, economic recession, bailout of savings and loan crisis.

Bill Clinton (1993-2001)

- National Debt at Start: $4.2 trillion

- National Debt at End: $5.7 trillion

- Key Factors: Economic growth, budget surpluses in the late 1990s.

George W. Bush (2001-2009)

- National Debt at Start: $5.7 trillion

- National Debt at End: $10.6 trillion

- Key Factors: Tax cuts, wars in Iraq and Afghanistan, 2008 financial crisis.

Barack Obama (2009-2017)

- National Debt at Start: $10.6 trillion

- National Debt at End: $19.9 trillion

- Key Factors: Stimulus spending to combat the Great Recession, Affordable Care Act, continued military expenditures.

Donald Trump (2017-2021)

- National Debt at Start: $19.9 trillion

- National Debt at End: $27.8 trillion

- Key Factors: Tax cuts, increased military spending, COVID-19 pandemic relief packages.

Joe Biden (2021-Present)

- National Debt at Start: $27.8 trillion

- National Debt (as of July 2024): Over $30 trillion

- Key Factors: COVID-19 pandemic recovery, infrastructure investments, social spending initiatives.

The Types of Presidential Decisions That Impact National Debt

Presidential decisions impacting the national debt include:

- Tax Policies: Changes in tax rates and tax cuts or increases can significantly affect government revenues.

- Spending Programs: Initiatives in defense, healthcare, and social services often require substantial funding.

- Economic Stimulus: Measures to boost the economy during recessions, such as bailouts and stimulus packages.

- War and Defense: Military engagements and defense spending can lead to increased borrowing.

- Infrastructure Investments: Large-scale infrastructure projects can necessitate significant funding.

Presidents Who Had The Greatest Impact on National Debt

Presidents Who Had The Greatest Impact on National Debt

- Franklin D. Roosevelt (1933-1945)

- Impact: Increased debt from $22.5 billion to $258.7 billion.

- Key Factors: New Deal programs, World War II expenditures.

- Ronald Reagan (1981-1989)

- Impact: Increased debt from $998 billion to $2.6 trillion.

- Key Factors: Tax cuts, defense spending, economic recovery programs.

- George W. Bush (2001-2009)

- Impact: Increased debt from $5.7 trillion to $10.6 trillion.

- Key Factors: Tax cuts, Iraq and Afghanistan wars, 2008 financial crisis.

- Barack Obama (2009-2017)

- Impact: Increased debt from $10.6 trillion to $19.9 trillion.

- Key Factors: Stimulus spending to combat the Great Recession, Affordable Care Act, continued military expenditures.

- Donald Trump (2017-2021)

- Impact: Increased debt from $19.9 trillion to $27.8 trillion.

- Key Factors: Tax cuts, increased military spending, COVID-19 pandemic relief packages.

These presidents significantly influenced the national debt through policies involving taxation, spending, military engagements, and economic interventions.

WHY IS THE NATIONAL DEBT SO HIGH?

The U.S. national debt is high due to a combination of factors involving economic policies, unforeseen events, and structural budget issues. Here are the primary reasons:

- Persistent Budget Deficits:

- The government often spends more than it receives in revenues, resulting in annual budget deficits that accumulate into national debt.

- Tax Policies:

- Tax cuts reduce government revenue. While intended to stimulate economic growth, they can significantly increase the deficit if not matched by spending cuts.

- Military Spending:

- Sustained high levels of defense and military expenditure, especially during periods of conflict, contribute substantially to the national debt.

- Economic Stimulus and Bailouts:

- Responses to economic crises, such as the 2008 financial crisis and the COVID-19 pandemic, involve massive stimulus packages and bailouts to stabilize the economy, adding to the debt.

- Social Programs and Entitlements:

- Costs for Social Security, Medicare, and Medicaid have risen significantly as the population ages, increasing mandatory spending.

- Interest on Debt:

- As the debt grows, so do interest payments, which become a larger portion of the budget, reducing funds available for other needs.

- Infrastructure and Public Investments:

- Investments in infrastructure, education, and other public services often require significant upfront expenditure, financed through borrowing.

- Economic Conditions:

- Recessions and economic downturns reduce tax revenues and increase spending on social safety nets, exacerbating budget deficits.

- Political Decisions:

- Legislative gridlock and political decisions often delay necessary fiscal reforms, contributing to ongoing deficits.

The national debt is high due to a combination of structural budget deficits, tax policies, military and social spending, economic stimuli, and interest payments. These factors, compounded by economic conditions and political decisions, have led to the accumulation of a significant national debt over time.

WHAT IS THE NATIONAL DEBT COSTING US?

The high national debt impacts the U.S. economy and its citizens in several significant ways:

- Interest Payments:

- Cost: A substantial portion of the federal budget goes towards paying interest on the debt, diverting funds from other critical areas like education, healthcare, and infrastructure.

- Impact: As the debt grows, interest payments increase, exacerbating budget deficits.

- Reduced Fiscal Flexibility:

- Cost: High debt limits the government’s ability to implement fiscal policies effectively, especially during economic crises.

- Impact: Limited resources are available for new initiatives or emergency responses, potentially hindering economic recovery and growth.

- Higher Borrowing Costs:

- Cost: Increased national debt can lead to higher interest rates as investors demand more return for perceived risk.

- Impact: Higher interest rates affect not just government borrowing but also consumer and business loans, including mortgages, auto loans, and business investments.

- Crowding Out Effect:

- Cost: Government borrowing can crowd out private investment by increasing interest rates and reducing the amount of capital available for private sector use.

- Impact: Reduced private investment can slow economic growth and innovation.

- Inflation Risk:

- Cost: Excessive borrowing and money printing to finance debt can lead to inflation.

- Impact: Inflation erodes purchasing power, affecting consumers’ ability to buy goods and services.

- Dependence on Foreign Lenders:

- Cost: A significant portion of the U.S. debt is held by foreign investors and governments.

- Impact: This dependence can pose geopolitical risks and reduce national sovereignty over economic policies.

- Intergenerational Burden:

- Cost: Future generations will inherit the responsibility of servicing and potentially repaying the debt.

- Impact: This could limit future economic opportunities and necessitate higher taxes or reduced government services for future citizens.

- Potential for Fiscal Crisis:

- Cost: Unsustainable debt levels can lead to a loss of confidence among investors, potentially triggering a fiscal crisis.

- Impact: A fiscal crisis could result in severe austerity measures, economic downturns, and social unrest.

The national debt costs the U.S. economy through high interest payments, reduced fiscal flexibility, higher borrowing costs, and the potential crowding out of private investment. It also poses risks of inflation, dependence on foreign lenders, an intergenerational burden, and the potential for a fiscal crisis. Managing and reducing the national debt is crucial to mitigate these costs and ensure long-term economic stability.

WHY DOES THE NATIONAL DEBT MATTER?

The national debt is a crucial economic indicator and has significant implications for the country’s fiscal health and overall economy. Here’s why it matters:

- Economic Stability:

- Impact: High levels of national debt can threaten economic stability. Excessive debt may lead to higher interest rates and inflation, which can destabilize the economy and reduce growth prospects.

- Interest Payments:

- Impact: A significant portion of the federal budget is dedicated to paying interest on the national debt. This diverts resources away from critical public services like education, healthcare, and infrastructure.

- Fiscal Flexibility:

- Impact: High debt limits the government’s ability to respond to economic downturns and emergencies. It reduces fiscal space for implementing new policies or increasing spending during crises.

- Future Generations:

- Impact: Large national debt levels shift the burden of repayment to future generations. This could result in higher taxes, reduced public services, or both for future citizens.

- Investor Confidence:

- Impact: Persistent high debt can affect investor confidence. If investors believe that debt levels are unsustainable, it could lead to higher borrowing costs and reduced investment.

- Economic Growth:

- Impact: High national debt can crowd out private investment by raising interest rates. This can slow economic growth and reduce opportunities for businesses and individuals.

- Inflation Risks:

- Impact: Excessive debt and money printing to cover deficits can lead to inflation. This erodes purchasing power and can create uncertainty in the economy.

- Global Perception:

- Impact: The national debt affects how the U.S. is perceived globally. High debt levels can influence foreign relations and affect the country’s credit rating.

- Budget Prioritization:

- Impact: High debt necessitates prioritizing debt service over other budgetary needs. This can lead to cuts in essential programs and services.

The national debt matters because it influences economic stability, fiscal flexibility, and investor confidence. It impacts future generations, affects economic growth, and poses risks of inflation. Additionally, it shapes global perceptions and budget prioritization. Managing the national debt is essential to maintain economic health and ensure sustainable fiscal policies.

Read more: 12 Legit Ways To Live Free Rent / How to get free rent

Funding Programs & Services

The national debt impacts how effectively the government can fund various programs and services. Here’s how it affects key areas:

- Healthcare:

- Impact: High debt levels limit the ability to expand or sustain healthcare programs like Medicare and Medicaid. Budget constraints can lead to cuts or reduced benefits.

- Education:

- Impact: Debt-related budget constraints may reduce funding for public education, impacting school quality, teacher salaries, and student resources.

- Infrastructure:

- Impact: Limited fiscal flexibility due to high debt can slow investments in critical infrastructure projects, affecting transportation, utilities, and public facilities.

- Social Services:

- Impact: Programs such as Social Security, unemployment benefits, and welfare may face cuts or reduced funding, affecting vulnerable populations.

- Defense and Security:

- Impact: High debt can limit the ability to fund defense and national security adequately, potentially affecting military readiness and security measures.

- Research and Development:

- Impact: Funding for scientific research and technological innovation may be constrained, impacting long-term economic growth and innovation.

- Emergency Response:

- Impact: The ability to respond to natural disasters, public health crises, and other emergencies can be hampered by debt-driven budget limitations.

The national debt affects the government’s capacity to fund essential programs and services, including healthcare, education, infrastructure, social services, defense, research, and emergency response. High debt levels can lead to reduced funding, budget cuts, and limitations on expanding or maintaining these critical areas.

The Growing National Debt

The Growing National Debt

The national debt has been steadily increasing due to persistent budget deficits, rising government spending, and economic policies. Key factors include:

- Annual Deficits: Consistent government spending exceeds revenue, leading to increased borrowing.

- Interest Payments: Growing debt results in higher interest obligations, further adding to the total debt.

- Economic Stimulus: Measures like tax cuts and spending programs, while aimed at boosting the economy, contribute to debt growth.

- Unplanned Expenditures: Costs related to emergencies, wars, and financial crises escalate debt levels.

The Debt Ceiling

The Debt Ceiling

The debt ceiling is a legislative limit on the amount of money the federal government can borrow to cover expenses. Key aspects include:

- Purpose: It ensures that the government does not exceed a predefined borrowing limit, requiring Congressional approval to raise it.

- Impact: When the ceiling is reached, the government can no longer issue new debt without increasing the limit, potentially leading to a government shutdown or default if not addressed.

- Political Implications: Debates over raising the debt ceiling often involve negotiations on budget priorities and fiscal policies, influencing government spending and economic stability.

The debt ceiling is a crucial tool for managing federal borrowing and ensuring fiscal responsibility, but it also presents challenges and risks if not handled effectively.

Breaking Down the Debt

Understanding the national debt involves examining its components and sources:

- Public Debt:

- Description: Includes Treasury securities held by individuals, institutions, and foreign governments.

- Impact: Public debt represents the portion of the national debt that is subject to market fluctuations and investor sentiment.

- Intragovernmental Holdings:

- Description: Debt held by government trust funds, such as Social Security and Medicare.

- Impact: These holdings reflect the amounts the government owes to itself for future benefits and obligations.

- Gross vs. Net Debt:

- Gross Debt: The total amount of money the government owes, including both public and intragovernmental debt.

- Net Debt: The gross debt minus the amount held in trust funds and other government accounts.

- Interest Costs:

- Description: The annual expenses for servicing the debt, including interest payments.

- Impact: Interest costs are a significant portion of the federal budget and can constrain spending on other priorities.

- Debt-to-GDP Ratio:

- Description: Measures the national debt as a percentage of Gross Domestic Product (GDP).

- Impact: A high debt-to-GDP ratio indicates a higher debt burden relative to the size of the economy, affecting fiscal policy and economic stability.

- Historical Trends:

- Description: Examines how debt levels have changed over time, influenced by fiscal policies, wars, economic conditions, and emergencies.

- Impact: Historical trends provide context for current debt levels and future projections.

Understanding these elements helps in assessing the overall health of the national debt and its implications for economic policy and fiscal management.

Maintaining the National Debt

Effectively managing the national debt involves several strategies to ensure fiscal health and economic stability:

- Fiscal Responsibility:

- Description: Implementing balanced budgets by aligning government spending with revenue.

- Impact: Reduces the need for borrowing and helps stabilize debt levels over time.

- Debt Management Strategies:

- Description: Employing strategies to manage debt service costs, such as refinancing and adjusting maturity schedules.

- Impact: Helps lower interest expenses and manage debt more efficiently.

- Revenue Enhancement:

- Description: Increasing government revenues through tax reforms, closing loopholes, and improving tax collection.

- Impact: Boosts revenue without increasing debt and supports budgetary needs.

- Expenditure Control:

- Description: Reviewing and controlling government spending, prioritizing essential programs, and reducing waste.

- Impact: Ensures that spending is sustainable and aligned with revenue, helping manage debt growth.

- Economic Growth:

- Description: Promoting policies that stimulate economic growth, which can increase tax revenues and reduce the relative debt burden.

- Impact: A growing economy can enhance fiscal health and improve debt-to-GDP ratios.

- Debt Ceiling Management:

- Description: Managing the debt ceiling to avoid crises and ensuring timely adjustments to accommodate fiscal needs.

- Impact: Prevents government shutdowns and defaults, maintaining fiscal stability.

- Public Communication:

- Description: Transparently communicating debt management policies and fiscal strategies to the public and investors.

- Impact: Builds confidence and trust, influencing investor behavior and economic stability.

Maintaining the national debt involves balancing fiscal policies, managing debt service costs, enhancing revenues, controlling expenditures, and promoting economic growth to ensure long-term financial stability.

Tracking the Debt

Monitoring the national debt is crucial for understanding its impact and ensuring fiscal responsibility. Here’s how to effectively track the debt:

- Regular Reports:

- Description: Review periodic reports from the U.S. Treasury and the Congressional Budget Office (CBO) for updates on debt levels and projections.

- Impact: Provides current data and forecasts, helping assess trends and fiscal health.

- Debt-to-GDP Ratio:

- Description: Track the ratio of national debt to Gross Domestic Product (GDP) to gauge debt relative to economic output.

- Impact: Offers insight into the sustainability of debt levels and economic stability.

- Government Websites:

- Description: Use official sources like TreasuryDirect.gov and the U.S. Debt Clock for real-time debt data and historical information.

- Impact: Ensures access to accurate and up-to-date debt figures.

- Economic Indicators:

- Description: Monitor related economic indicators such as interest rates, inflation, and budget deficits that influence debt dynamics.

- Impact: Helps understand how broader economic factors affect debt management.

- Legislative Updates:

- Description: Follow legislative changes and debates concerning the debt ceiling and fiscal policies.

- Impact: Provides context for changes in debt levels and potential future impacts.

- Debt Analysis Reports:

- Description: Review analyses from think tanks, financial institutions, and economic research organizations.

- Impact: Offers independent perspectives and detailed insights into debt trends and implications.

Tracking the national debt involves monitoring official reports, economic indicators, legislative updates, and independent analyses to stay informed about debt levels and their impact on the economy.

Dive Deeper into the Debt

Understanding the national debt requires a thorough exploration of its components, implications, and management strategies. Here’s a deeper look:

- Components of National Debt:

- Public Debt: Includes Treasury bills, notes, and bonds held by investors, institutions, and foreign governments. It reflects the amount borrowed from outside the government.

- Intragovernmental Holdings: Debt held by various government trust funds, such as Social Security and Medicare. This represents internal borrowing from one government account to another.

- Debt Management Practices:

- Refinancing: Rolling over maturing debt into new securities to manage interest costs and adjust the debt maturity profile.

- Debt Issuance: Selling new government securities to finance current spending, which affects overall debt levels and interest obligations.

- Economic Impact:

- Interest Costs: High debt increases interest payments, which can crowd out other spending and limit fiscal flexibility.

- Inflation: Excessive borrowing can lead to inflation if it’s financed by money creation, affecting purchasing power and economic stability.

- Debt Sustainability:

- Debt-to-GDP Ratio: This ratio measures the debt level relative to the size of the economy. A rising ratio may indicate growing debt relative to economic output, raising concerns about sustainability.

- Fiscal Policies: Effective fiscal policies are necessary to manage debt levels. This includes balancing budgets, controlling spending, and ensuring adequate revenue.

- Political and Social Implications:

- Legislative Decisions: Political decisions, such as tax reforms and spending cuts, directly impact debt levels and management strategies.

- Public Perception: High debt levels can influence public confidence and perceptions about government financial stability and policy effectiveness.

- Global Perspectives:

- Comparative Analysis: Comparing the U.S. debt with other countries provides context on relative debt levels and management practices.

- International Impact: Global investors and foreign governments are significant holders of U.S. debt, affecting international relations and economic stability.

- Future Projections:

- Long-Term Forecasts: Analyzing future debt projections helps anticipate potential challenges and the need for policy adjustments.

- Economic Scenarios: Considering different economic scenarios helps understand how potential changes in growth rates, interest rates, and fiscal policies could impact debt.

Diving deeper into the national debt involves examining its components, management practices, economic impact, sustainability, and political implications. Understanding these factors provides a comprehensive view of how debt affects the economy and fiscal policy.

Historical Debt Outstanding

Understanding historical debt outstanding provides context for current debt levels and trends. Here’s a snapshot of key historical data and trends:

- Early U.S. Debt:

- Post-Revolutionary War: The U.S. initially incurred debt to finance the Revolutionary War. Early debt levels were relatively low compared to modern figures.

- 19th Century: Debt fluctuated with major events such as the Civil War, with substantial increases during periods of conflict.

- Post-World War II Era:

- 1940s: The national debt surged during World War II to fund military operations, reaching over $260 billion by 1945.

- 1950s-1970s: Debt remained relatively stable, with modest increases due to economic expansions and social programs.

- 1980s and 1990s:

- 1980s: The Reagan administration saw significant increases in debt due to tax cuts and increased defense spending. The debt nearly tripled during this period.

- 1990s: Debt levels continued to rise, though there were attempts to balance the budget. The 1990s saw the introduction of budget surpluses toward the end of the decade.

- 2000s and Financial Crises:

- 2000s: Debt grew due to tax cuts, wars in Afghanistan and Iraq, and increased spending. The debt surpassed $10 trillion by the end of the decade.

- 2008 Financial Crisis: The debt surged as the government implemented stimulus measures to counteract the recession and stabilize the financial system.

- 2010s:

- Post-Crisis: Debt continued to rise due to ongoing economic recovery efforts, entitlement programs, and tax policies. The debt reached over $20 trillion by the end of the decade.

- 2020s:

- COVID-19 Pandemic: The pandemic caused a significant increase in debt due to stimulus packages, healthcare expenses, and economic support measures. The national debt exceeded $31 trillion in recent years.

- Long-Term Trends:

- Debt-to-GDP Ratio: Historically, the ratio has fluctuated with economic conditions, wars, and fiscal policies. A rising ratio indicates a growing debt burden relative to the size of the economy.

- Interest Payments: As debt has grown, so have interest payments, which can constrain other spending and influence fiscal policy.

Summary

Historical debt outstanding reflects the impact of wars, economic policies, and crises on national debt levels. From early post-Revolutionary figures to modern levels influenced by recent financial crises and economic challenges, understanding these trends provides insight into the evolving nature of U.S. debt and its implications for fiscal policy.